Denver Real Estate Investment – What To Know

When looking at Denver real estate investment, it’s important to understand how far Denver has come. For a long time, Denver was known as the capital of the Rocky Mountain West, but due to the small population of that region of the US, it was almost considered a flyover town. Now, Denver is absolutely booming and has become not only a hub of the Rocky Mountain West but the US in general. Its quality of life, chic restaurants, and plentiful activities make it an incredibly attractive place to live, and its thriving business scene is drawing people in by the droves. But what about the real estate market? We’ll break down why you might consider investing in Denver and where to invest.

Looking to invest in Denver real estate that will generate some of the best rental yields around?

Why invest in Denver real estate?

Denver has long been one of the most desirable real estate markets in the country. With a strong economy, a growing population, and a limited housing supply, property values have steadily increased over the past decade. Whether you’re looking to buy and hold, rent long-term, or leverage Denver’s booming short-term rental market, real estate investment in the Mile High City presents strong profit potential.

Current market snapshot

- Home prices in Denver increased by 2% in 2024 and are expected to rise between up to 3% in 2025.

- Population growth continues to drive demand, with Denver County adding over 10,000 new residents annually.

- Inventory remains low, keeping property values stable despite high interest rates.

- Rental demand is strong, with a mix of long-term renters and tourists fueling both traditional leases and short-term rentals.

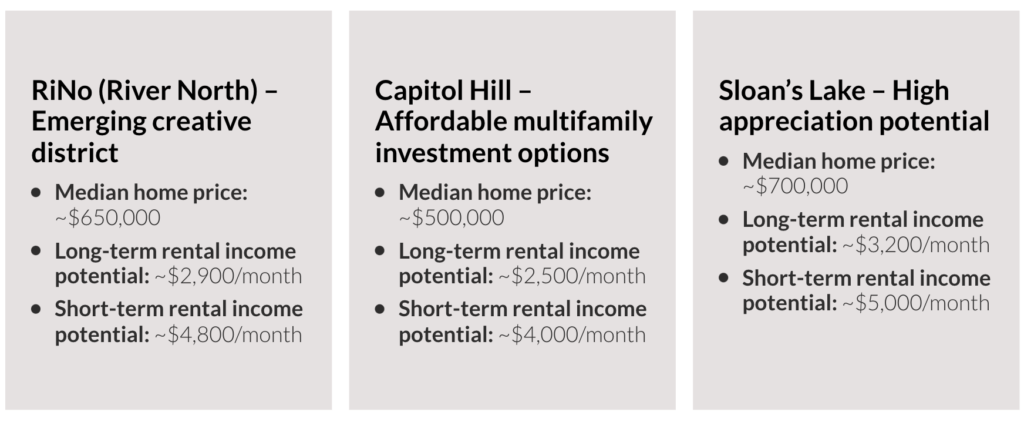

Best areas to invest in the city of Denver

It must be noted here that Denver consists of the city of Denver and metro Denver, which includes all of the surrounding areas. In the city of Denver, not all neighborhoods offer the same level of return. Some, like Capitol Hill and Five Points, suit long-term renters with steady demand and lower turnover. Others, such as RiNo, Sloan’s Lake, and Highlands, thrive as short-term rentals, attracting tourists and higher nightly rates but requiring more management. Choosing the right area depends on your investment strategy and how much you would like to risk.

Colorado is a great place from both an economic perspective, and Denver lawyer Robert Lantz of Lantz Law Group, sees mainly upside.

“Colorado is a great place for growth because big industries like tech, aerospace, and healthcare are bringing in talent and driving up property values and rental demand in cities like Denver and Boulder. Colorado Springs and Fort Collins are also growing because of the university crowds and people looking for more affordable options further out from the capital. The mountain towns are still popular for tourists and people buying vacation homes. Overall, the low cost of energy and skilled workforce in Colorado make it a good choice to do business and invest.“

Best areas to invest in metro Denver

These days, metro Denver might be an even better investment play than the city of Denver. Metro-Denver offers some outstanding options with price points that are cheaper than the city, and fewer regulations as it pertains to housing and rentals. This is important because the city of Denver has generally trended more regulatory over time, whereas the suburbs and surrounding counties have not. Below is a breakdown.

| Suburb | Location Relative to Denver | Investment Highlights |

|---|---|---|

| Lakewood | West | Strong rental market due to proximity to Denver and ample recreational spaces; diverse property options appealing to families and professionals. |

| Aurora | East | Planned communities with extensive amenities; strong property values and a family-friendly environment appeal to long-term renters and buyers. |

| Arvada | Northwest | Thriving cultural scene with ongoing development projects; competitive median home prices and favorable rental rates. |

| Littleton | South | Historic downtown with reputable schools; attracts families and professionals, ensuring consistent rental demand. |

| Highlands Ranch | South | A mix of residential options with a growing business sector; strategic location near major highways enhances investment potential. |

| Centennial | Southeast | Mix of residential options with a growing business sector; strategic location near major highways enhances investment potential. |

Property values and long-term rentals in metro Denver

Property values in the Denver metro suburbs have seen mixed trends, offering both challenges and opportunities for investors. Lakewood’s median home price is around $536,000, reflecting an 8.4% decline year-over-year, but rental demand remains strong with an average price per square foot of $290. Aurora, known for affordability, has a median home price of $375,503, with traditional rental income averaging $1,899 per month, making it an appealing market for buy-and-hold investors. Highlands Ranch stands out with a 5.7% price appreciation over the past year, pushing the median home price to $703,000. Arvada, Littleton, and Centennial continue to see steady growth, benefiting from proximity to Denver and strong community appeal.

Why is Denver and Colorado such a good real estate play? We spoke to Arron Bennett of Bennett Financials on why he thinks Colorado is on the up and up.

“Major cities, including Denver, Boulder, and Colorado Springs, continue to experience continued rise in property values and high rental demand due to the influx of professionals, strong tech industry, and an outdoor lifestyle. Tourism and short-term rental markets also play a role, particularly in resort areas such as Aspen, Vail, and Telluride, where vacation rentals yield high returns. Supply and demand trends, rental market conditions, and infrastructure development should also be closely watched by investors when looking for high-growth areas.“

Short-term rental market in metro Denver

According to AirDNA, short-term rental trends in the Denver metro area show a mix of growth and challenges, with some suburbs seeing strong returns while others face setbacks. Arvada stands out with an impressive $50.5K in annual revenue, marking a 19% jump year over year, driven by consistent demand. Littleton also saw a 14% revenue boost to $43.1K, with RevPAR (Revenue Per Available Room) rising 12% to $149.02, signaling steady growth. Lakewood, known for its stable rental market, pulled in $31.9K annually with a solid 65% occupancy rate, making it a reliable choice for investors.

On the flip side, Aurora’s short-term rental market lags behind, with the lowest RevPAR at $95.28, despite a 59% occupancy rate and a $160.55 average daily rate—indicating pricing struggles. Highlands Ranch, once a strong performer, saw a 15% revenue decline to $23.7K, along with a 17% drop in ADR (Average Daily Rate) to $153.23, suggesting weakening demand. These numbers highlight the volatile nature of Denver’s short-term rental market, where location and shifting demand play a crucial role in profitability.

Short-term vs. long-term rentals in Denver – What’s more profitable?

When investing in Denver real estate, one of the biggest decisions you’ll face is choosing between a short-term rental (STR) or a long-term lease. Both options offer distinct advantages, but their profitability depends on income potential, expenses, and Denver’s evolving rental laws.

Short-term rentals on platforms like Airbnb and VRBO can generate significantly higher revenue per night, making them attractive to investors looking for strong cash flow. However, they come with higher operating costs, seasonal fluctuations, and strict regulations that could impact profitability. On the other hand, long-term rentals provide steady, predictable income with lower management demands and fewer regulatory hurdles, but may not deliver the same high returns as a well-run short-term rental.

So, which investment strategy is better for Denver real estate investors? In this section, we’ll compare rental income, expenses, and key financial metrics to determine the most profitable option.

Profitability breakdown

Short-term rentals (STRs) on platforms like Airbnb and VRBO can generate higher gross income, but they also come with higher operational costs and strict regulations.

Highlands neighborhood – Short-term vs. long-term rental investment

An investor purchases a three-bedroom, two-bathroom home in Denver’s Highlands neighborhood for $750,000. The property is in a highly desirable area, just minutes from downtown, with easy access to restaurants, breweries, and popular attractions like Sloan’s Lake. Given the location, the investor weighs two options: renting the home as a long-term rental to a tenant or listing it as a short-term rental (STR) on Airbnb and VRBO.

Scenario 1: Long-term rental approach

The investor decides to lease the property as a long-term rental with a 12-month lease agreement. After researching rental comps, they determine that similar homes in the area rent for $3,500 per month.

Pros and Cons of long-term rental

| Pros of Long-Term Rental | Cons of Long-Term Rental |

|---|---|

| Stable and predictable income stream | Less flexibility to adjust rent based on market trends |

| Lower turnover and management costs | Lower income potential compared to short-term rentals |

| No need to constantly attract new guests | Tenancy laws that can result in squatters if certain criteria are met |

Scenario 2: Short-term rental approach

The investor considers listing the property as an Airbnb rental instead. With Highlands being a prime area for tourists and business travelers, the property could be rented for $350 per night, with an estimated 70% occupancy rate (about 255 nights per year).

Pros and cons of short-term rental

| Pros of Short-Term Rental | Cons of Short-Term Rental |

|---|---|

| Higher earning potential than a long-term rental | Requires more hands-on management (guest communication, turnovers, maintenance) |

| Dynamic pricing allows for rate increases during peak seasons | Regulatory risks (Denver’s strict STR laws may impact operations) |

| Greater flexibility if the owner wants to use the property personally | Higher expenses (cleaning, management fees, and guest amenities) |

Denver Short-Term rental laws and taxes

Denver has a booming short-term rental (STR) market, but operating an Airbnb or VRBO property in the city comes with strict regulations and tax obligations. Property owners must comply with licensing requirements, including proving that the rental is their primary residence. Failure to follow these rules can lead to hefty fines of up to $1,000 per violation.

It must also be stated that Denver imposes multiple taxes on short-term rentals, including a 10.75% lodger’s tax, 4.0% Colorado state tax, and 4.81% Denver city tax. These taxes significantly impact profitability, so investors need to factor them into their pricing strategy.

Property tax calculation – Short-term rental example in Sloan’s Lake

Let’s consider an investor who purchases a three-bedroom property in Denver’s Sloan’s Lake neighborhood for $725,000 with the intent to use it as a short-term rental. Sloan’s Lake is a high-demand area known for its proximity to downtown, scenic lake views, and strong rental market, making it a prime location for Airbnb and VRBO properties.

Step 1: Determine the assessed value

Denver applies an assessment rate of 6.95% on residential properties to determine taxable value.

Calculation:

$725,000 × 6.95% = $50,387.50 (assessed value)

Step 2: Apply the Mill Levy

The mill levy is the tax rate applied to the assessed value, expressed in mills (1 mill = $1 per $1,000 of assessed value).

Denver’s average combined mill levy is 72.116 mills.

Calculation:

$50,387.50 × 0.072116 = $3,635.81 (annual property tax)

Additional expenses for short-term rental property

Beyond property taxes, STR owners in Sloan’s Lake must consider operating costs such as insurance, maintenance, management fees, and taxes on rental income.

| Expense Category | Annual Cost |

|---|---|

| Property Tax | $3,635.81 |

| Homeowners Insurance (STR policy) | $2,400 |

| Property Management Fees (20% of income) | $13,750 |

| Maintenance & Repairs | $4,000 |

| Lodger’s & Sales Taxes (10.75% + 4.81% + 4.0%) | $8,900 |

| Cleaning Fees & Supplies | $6,200 |

| Total Estimated Expenses | $38,886.81 |

With these costs, an investor in Sloan’s Lake’s short-term rental market must optimize their pricing strategy and occupancy rates to ensure they maximize profits while covering taxes and operating expenses.

Financing options for Denver real estate investors

Securing the right financing is key to maximizing returns on a Denver real estate investment. Whether you’re purchasing a rental property or a short-term Airbnb, the loan type, interest rate, and down payment can impact profitability and cash flow. Investors can choose from traditional mortgages, DSCR loans, or hard money loans, each with its own benefits and requirements.

Best mortgage options for Denver real estate investors

Choosing the right mortgage is essential for maximizing cash flow and return on investment. Each financing option comes with its own requirements, risks, and benefits, depending on the investor’s strategy.

Conventional loans

- Require 20-25% down for investment properties, which is higher than for primary residences.

- Offer lower interest rates than alternative financing options, making them ideal for long-term investors.

- Require strong credit scores (typically 680+), stable income, and a low debt-to-income ratio.

DSCR loans (debt service coverage ratio loans)

- Designed for real estate investors, these loans do not require personal income verification.

- Instead of personal financials, lenders assess whether the property’s rental income can cover the mortgage payments.

- Ideal for investors with multiple rental properties or those who don’t meet traditional employment requirements.

Hard money loans

- Short-term, higher-interest loans (often 8-12% interest) are used for quick purchases, renovations, and flips.

- Typically require a lower credit score but come with higher fees and shorter repayment periods (6-24 months).

- Best for investors looking to buy, renovate, and resell properties quickly rather than hold long-term rentals.

Mortgage Costs Breakdown

| Loan Amount | 20% Down | 25% Down |

|---|---|---|

| $500,000 | $100,000 | $125,000 |

| $600,000 | $120,000 | $150,000 |

| $750,000 | $150,000 | $187,500 |

Looking for consulting services that include purchase consulting, financing consulting, and front-to-back short-term rental management?

The future outlook for Denver real estate investment

Devner’s real estate market is going to be a very smart investment place for the foreseeable future. Denver’s real estate market is set to stay strong, fueled by steady population growth and housing demand. With more people moving in for jobs and quality of life, both long-term rentals and homeownership are seeing increased demand, making the right property in the right area a solid investment. In the city of Denver, short-term rental rules are tightening, and stricter enforcement could push investors toward long-term leases. In metro Denver’s surrounding areas, lower property values and less intense regulation make these locations more suitable for short-term rental.

Until Denver solves its housing supply issue, property values should continue to go up, albeit not as strongly as years prior. That being said, if you invest in Denver real estate with the goal of renting it out, you should be on pretty solid ground in terms of both price stability and growth, as well as yield.

This data is primarily derived from national figures and may fluctuate regionally or over time. Readers should consider the variability when interpreting the data and are encouraged to verify specific details before making decisions based on this information. Please reach out to us for a detailed, customized projection for specific addresses

FAQ

Is it better to invest in single-family homes or multifamily properties in Denver?

Both single-family and multifamily properties have their advantages in Denver’s real estate market. Single-family homes typically offer higher appreciation potential and attract long-term tenants looking for stability. Multifamily properties, on the other hand, can generate stronger cash flow, as multiple units provide rental income diversification. The best choice depends on your investment goals—whether you prioritize appreciation or consistent rental income.